Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. It involves taking calculated risks to achieve financial goals. Investing is an important part of personal finance and can help individuals achieve their long-term financial goals, such as retirement, buying a home, or starting a business. By investing early and regularly, individuals can take advantage of the power of compounding and increase their wealth over time.

There are various types of investments, including stocks, bonds, mutual funds, real estate, and commodities. Each type of investment carries a different level of risk and potential return. Understanding the risk and return characteristics of different investments is essential to making informed investment decisions. When building an investment portfolio, it’s important to consider one’s financial goals, time horizon, and risk tolerance. A well-diversified portfolio that includes a mix of different asset classes can help reduce risk and increase potential returns.

Building a solid investment portfolio doesn’t have to be complicated. One can use funds or even a robo-advisor to build a simple and effective portfolio. When selecting investments, it’s important to match the account type with one’s goals and to gradually build up the portfolio over time. Additionally, diversifying across different types of investments is crucial for minimizing risk. By following these basic principles, beginner investors can start building a solid investment portfolio and make smart decisions for their financial future.

Building a Solid Investment Portfolio

When building a solid investment portfolio, it is important to start by setting clear investment goals. This involves determining what you are investing for, whether it is for short-term or long-term goals, and how much risk you are willing to take on. Once you have established your investment goals, you can begin to diversify your investments. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and cash, to reduce the overall risk of your portfolio. By diversifying, you can protect your portfolio from market volatility and potentially increase returns.

To further diversify your investments, it is important to balance risk and return. This means considering the potential returns of an investment in relation to its level of risk. Typically, investments with higher levels of risk have the potential for higher returns, while lower-risk investments may offer lower returns. However, it is important to balance your portfolio with both high-risk and low-risk investments to avoid putting all your eggs in one basket. Additionally, you should look for asset classes that have low or negative correlations so that if one investment decreases in value, another may increase in value, helping to mitigate overall risk.

Once you have established your investment goals, diversified your investments, and balanced risk and return, you can begin selecting individual assets for your portfolio. This involves researching and analyzing potential investments, such as stocks, bonds, and mutual funds, to determine their potential for growth and return on investment. When selecting investments, it is important to consider factors such as the company’s financial health, industry trends, and market conditions. By following these steps, you can build a solid investment portfolio that aligns with your goals and helps you make smart investment decisions.

Making Smart Investment Decisions

To make smart investment decisions, it is essential to conduct thorough research and due diligence. This includes researching the companies or assets you plan to invest in, as well as understanding the potential risks and rewards of each investment option. It is also important to diversify your investments across different asset classes, industries, and geographies to minimize risk and maximize returns. Additionally, it is crucial to determine your investment goals and risk tolerance before making any investment decisions. By conducting proper research and diversifying your portfolio, you can make informed investment decisions that can lead to long-term financial success.

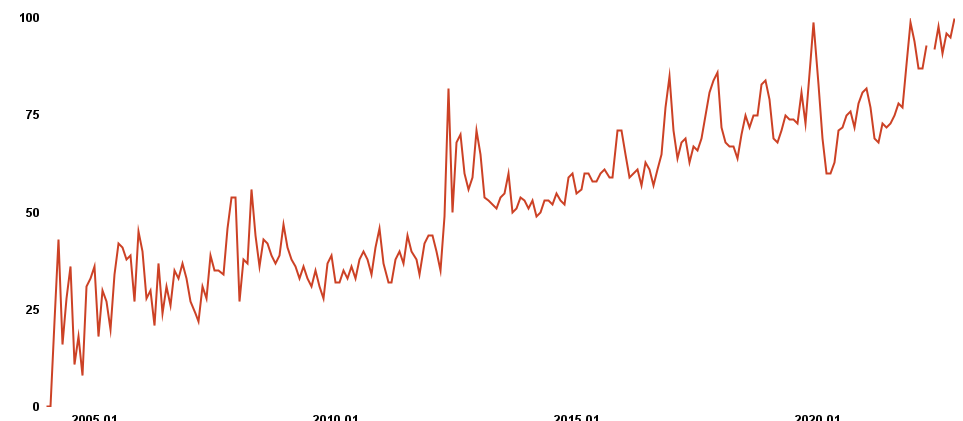

Understanding market trends is another critical aspect of making smart investment decisions. Keeping up with the latest news and trends in the financial markets can help you identify potential investment opportunities and avoid making impulsive decisions based on short-term market fluctuations. It is also essential to have a long-term investment strategy and stick to it, rather than trying to time the market or make quick profits. By staying informed and having a solid investment plan, you can make smart investment decisions that align with your financial goals.

Finally, it is crucial to avoid common investment mistakes that can lead to significant financial losses. These mistakes include investing without clear goals or timelines, letting emotions guide investment decisions, and failing to diversify your portfolio. It is also important to avoid investing money that you cannot afford to lose and to seek the help of a financial advisor if needed. By avoiding these common investment pitfalls and making informed investment decisions, you can build a solid investment portfolio that can lead to long-term financial success.

Monitoring and Adjusting Your Portfolio

Regular portfolio review is an essential aspect of investing that helps investors stay on track with their goals. It is recommended that investors review their portfolio at least once a year to ensure that it aligns with their investment objectives and risk tolerance. Through regular portfolio review, investors can identify any underperforming assets and make necessary adjustments to their portfolio to maximize returns.

Rebalancing investments is another crucial step in maintaining a solid portfolio. Diversification is key to successful investing, and it is important to ensure that the portfolio is not overexposed to any one asset class. Over time, market fluctuations can cause the portfolio to become unbalanced, and certain assets may become over or underrepresented. Rebalancing involves selling overrepresented assets and reinvesting the proceeds into underrepresented assets to maintain the desired asset allocation.

Staying disciplined and focused on long-term goals is also critical to building a solid investment portfolio. Investing requires making informed decisions based on future events, and it is important to keep a long-term perspective. In addition, investors should not be swayed by short-term market fluctuations and should avoid making impulsive decisions based on emotions. Sticking to a well-thought-out investment plan and maintaining a diversified portfolio can help investors stay disciplined and achieve their long-term investment goals.